My paycheck after taxes

Payroll taxes and income tax. IR-2018-230 Get Ready for Taxes.

Understanding Your Paycheck Credit Com

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15.

. An MMM-Recommended Bonus as of August 2021. The taxes you owe on your 401k distributions at retirement depend on whether your funds are in a traditional 401k or a Roth 401k. In six states and US.

Three states have unemployment insurance taxes. Eligible plan types include traditional IRAs and 401ks. Oh and when we say changing most of the time that means increasing.

The Future of Finances. View your Paychecks. 4 Things To Know About Stimulus Checks the CARES Act.

So if the interest rate. So if you discover youre required to pay quarterly taxes you must first use Schedule C of Form 1040 to determine how much you owe. For instance people who have a W-2 job on top of their 1099 income may pay enough in taxes through their W-2 full-time job.

Form 1040-ES contains a worksheet that is similar to Form 1040 or. Money you contribute to a 401k is pre-tax which means the contributions come out of your paycheck before income taxes are removed. What you need to know about the Paycheck Protection Program part of the recently passed CARES Act.

2 my tax liability is 5500 dollars. B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not. Tax reform changes likely to reduce number of taxpayers who itemize.

Filing Taxes 2022 Back to School Finances GEN Z. To learn more about the process please see this article. Contributions to these plans are considered pre-tax and are therefore exempt from federal income tax during the.

Invite your Employees to See Pay Stubs W-2s and More. F Participation in the paycheck protection program--In an agreement. Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal income tax withholding this year.

Termination of residency after June 3 2004 and before June 17 2008. How to Pay Quarterly Taxes. Wheres My State Tax Refund Delaware.

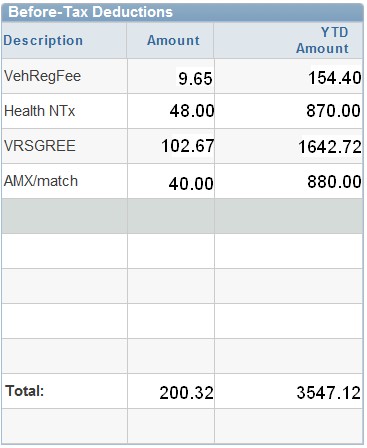

After that youll receive an email with a link to set up and view your paystubs. You can also make pre-tax contributions by enrolling in flexible spending accounts FSAs and health savings accounts HSAs. If youre wondering what percentage of your paycheck is withheld for federal income tax and how you can adjust it it all comes down to Form W-4.

Territories employees pay disability taxes. Federal income taxes are paid in tiers. For a single filer the first 9875 you earn is taxed at 10.

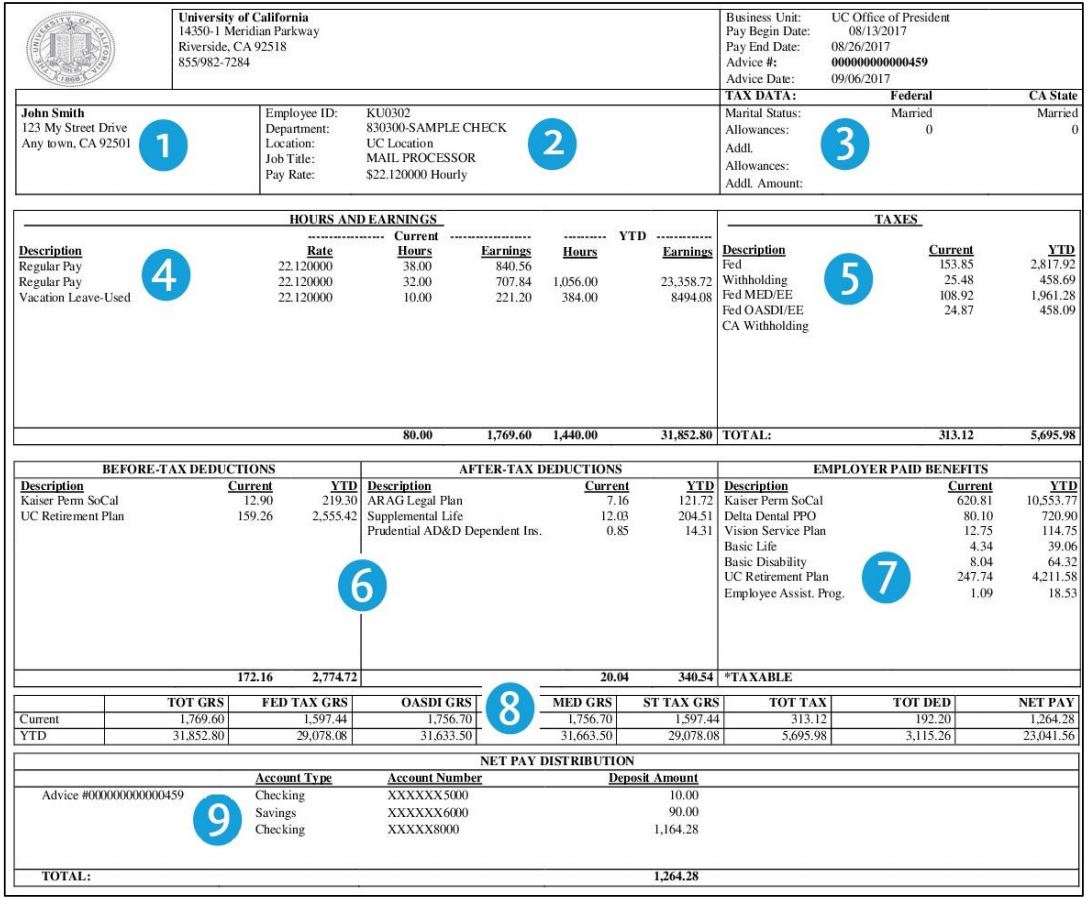

Advice Advice Date. If you terminated your residency after June 3 2004 and before June 17 2008 you will still be considered a US. How Do I Make My Quarterly Payments.

For most workers thats 62 percent Social Security and 145 percent Medicare of your gross earnings out of every paycheck. Wheres My Tax Refund Washington DC. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

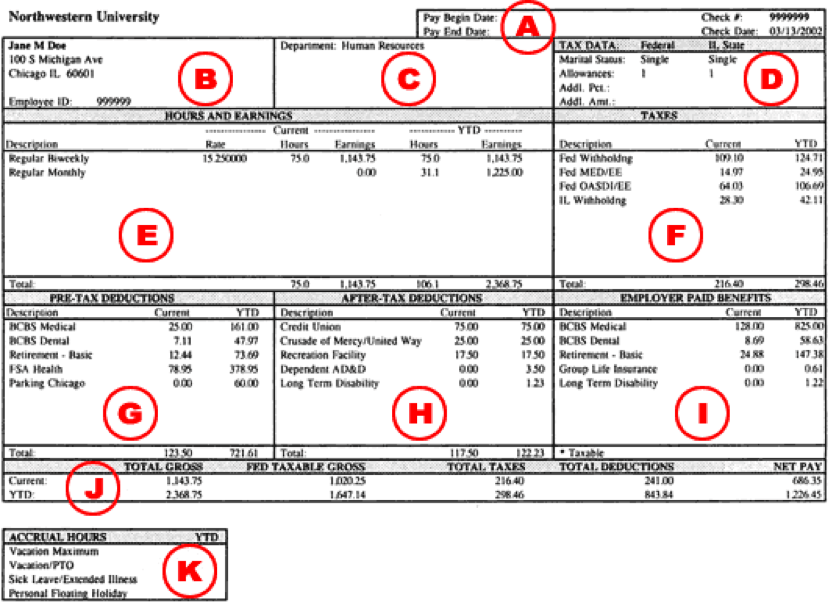

Total amount for current payperiod and year-to-date total before taxes. Employers withhold or deduct some of their employees pay in order to cover. A 100000 paycheck is much smaller after taxes.

More Information on Paycheck Taxes. Additionally Ive added an article thatll help you see your paystubs in Workforce. Money may also be deducted or subtracted from.

Resident for tax purposes until you notify the Secretary of Homeland Security and file Form 8854. Total amount for current payperiod and year-to-date total less federal pre-tax amounts. Estimated tax is the method used to pay Social Security and Medicare taxes and income tax because you do not have an employer withholding these taxes for you.

If you have questions about other amounts or tax items on your paycheck stub check with your manager or your human resources department. For more specific status updates visit the states Refund Inquiry Individual Income Tax Return page. IR-2018-222 IRS provides tax inflation adjustments for tax year 2019.

Although the Golden State has high taxes it does play host to a number of bustling industries. How to change your take-home pay. Why would this happen.

636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F. One state has a workers compensation tax. 4 Without ITC I would have to send IRS 500 difference 5 with ITC I would a get a refund from the IRS of the 5000 withheld from my paycheck b I wouldnt owe them 500 c I would have 1500 left to apply to next years liability.

The advantage of pre-tax contributions is that they lower your taxable income. Form 1040-ES Estimated Tax for Individuals PDF is used to figure these taxes. On her W4 and she had taxes withheld each pay period.

Annual pay blank if student assistant G. A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. 3 I had 5000 withheld from my paycheck for federal taxes year.

Your taxes may also be impacted if you contribute a portion of your paycheck to a tax-advantaged retirement savings account. Does My IRA or 401k Change My Filing Status. Californias taxes are some of the highest in the US with a base sales tax rate of 725 and a top marginal income tax rate of 133.

A paycheck to pay for retirement or health benefits. A In General--Section 7a of the Small Business Act 15 USC. IR-2018-127 Law change affects moving.

But Social Security and Medicare taxes are only withheld from earned income such as wages. In the aftermath of COVID-19s wake we also have ways to help you navigate questions you may have after the financial implications of living through a global. And B by adding at the end the following.

That way the mortgage lender doesnt feel the effects of those changing interest ratesyou do. We used SmartAssets paycheck calculator to find out how much Americans earning a 100000 salary take home after federal state and local. If youre expecting a big refund.

Throughout your working years youve paid payroll taxes for Social Security and Medicare. Unique paycheck number Paycheck date. But after that your rate can change based on a lot of factors like the mortgage market and the rate that banks themselves use to lend each other money.

1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. You will need to enter your SSN and your refund amount. Even if you did a Paycheck Checkup last year you should do it again to account for differences from TCJA or life changes.

The amount of money you. My spouse entered the same info. After realizing my employer had not withheld any federal taxes all year I inquired and they said that because my dependent amount is set to 4000 no federal taxes have come out.

Refunds from Delaware tax returns generally take four to 12 weeks to process.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding Your Paycheck Human Resources Northwestern University

Here S How Much Money You Take Home From A 75 000 Salary

My Paycheck Administrative Services Gateway University At Buffalo

Understanding Your Paycheck

Paycheck Calculator Online For Per Pay Period Create W 4

Here S How Much Money You Take Home From A 75 000 Salary

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Check Your Paycheck News Congressman Daniel Webster

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Taxes Federal State Local Withholding H R Block

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Direct Deposit Advice Jmu

Tax Information Career Training Usa Interexchange

New Paycheck Ucpath