Health insurance payroll deduction calculator

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Elective Deferrals401k etc Payroll Taxes Taxes Rate Annual Max Prior YTD CP.

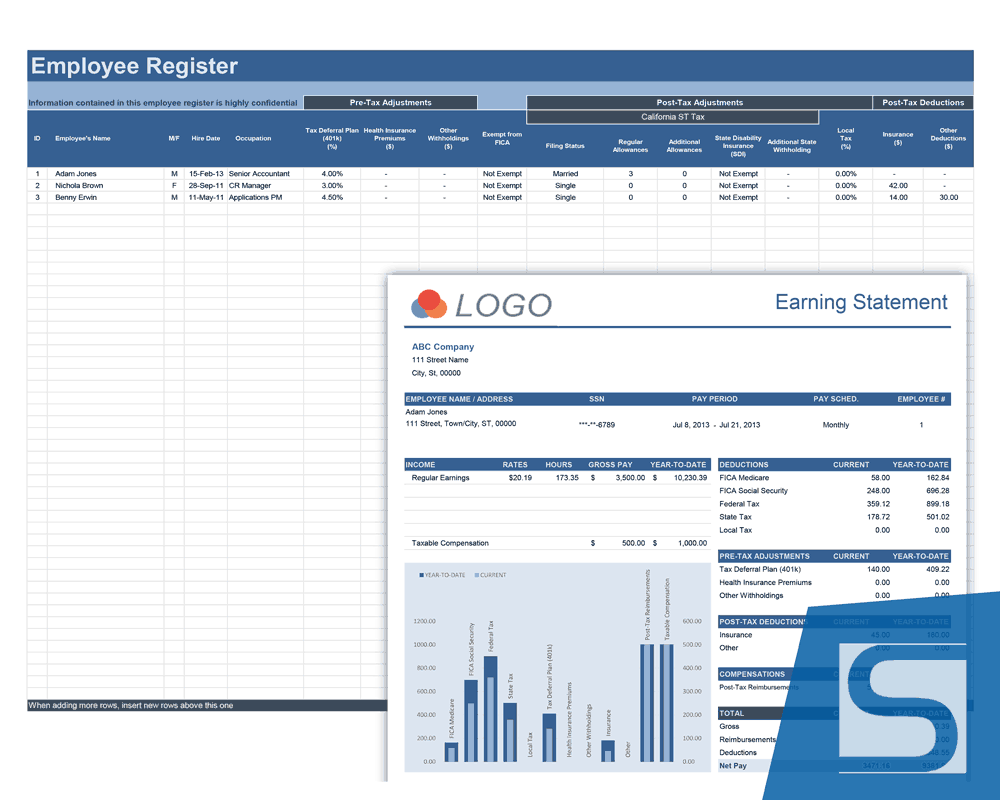

Payroll Calculator Free Employee Payroll Template For Excel

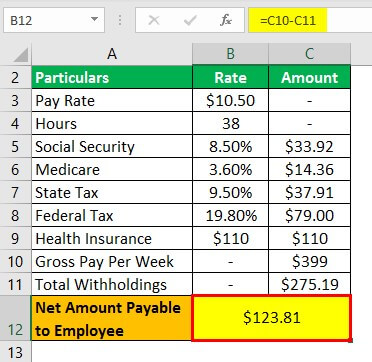

Payroll deductions consist of money taken out of an employees paycheck.

. Skip to main content. Ohio payroll taxes can be a little hard to keep track of. The maximum annual contribution is 42371.

Check your pay stubs if youre unsure how youre paying for insurance thats available through your employer. Pre-Tax Deductions Pre-tax Deduction Rate Annual Max Prior YTD CP. Her health insurance premium increases to 10000 for the year.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. Pre-Tax Salary Deduction. Once your name is changed in PEEHIPs system the insurance carriers will issue new insurance cards with your new name.

If you need help estimating how withholding or deductions changes will affect your net pay or taxes Central Payroll Bureaus Net Pay Calculator can be useful in estimating taxes and net pay. Mississippi State Payroll Taxes. Employees paid the remaining.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Payroll deductions can also be voluntary or mandated. Find out the average cost of health insurance in your area in our state-by-state guide.

Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. Before deduction and taxes Step 3. New York Paid Family Leave is insurance that is funded by employees through payroll deductions.

Health Insurance POP etc SalariedAmount. Periodic liability calculator for the payroll tax liability to include in your periodic return and any UTI that may apply. Ohio State Payroll Taxes.

Youll find the deduction on your personal income tax form and you can file for it if you were self-employed and showed a profit for the. If you earn a wage or a salary youre likely subject to Federal Insurance Contributions Act taxes. This process can be.

The reliability of the calculations produced depends on the. Determine your payroll deduction. Health insurance premiums for medical dental and vision plans.

In most cases employers deduct the payment from your paycheck as a pre-tax deduction. Enter the amount of money youd like to take home each pay period and the gross pay calculator will tell you what your before-tax earnings need to be. The deduction which youll find on Line 17 of Schedule 1 attached to your Form 1040 allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.

But for the ones that do you will need to make a deduction here and send the deduction to the appropriate jurisdiction. It will confirm the deductions you include on your official statement of earnings. You assume the risks associated with using this calculator.

Not to be confused with the federal income tax FICA taxes fund the Social Security and Medicare programs. You must lodge a return through QRO Online so that we can confirm your payroll tax liability. The Payroll Calculator is intended to be a general information tool on payroll simulations.

Determine Total Time worked for the period. Fixed periodic deduction calculator for the fixed periodic deduction to include in your periodic return. If your employees have post-tax deductions which can be anything from garnishments like child support to life insurance you will need to make a deduction here and send the deduction to the appropriate jurisdiction.

Use the calculator below to. These deductions are used for a few purposes such as paying taxes contributing to a retirement plan and paying for benefits like health insurance. Tax Deduction vs.

She changes to family coverage only to add her 26-year-old nondependent child to the plan. Subtract Deductions and Taxes from Gross Pay. Health insurance Deduction Tax base Income tax Net salary Work insurance contribution Company taxes Total company cost Disclaimer.

For a better understanding of payroll deductions keep reading. In 2020 the standard company-provided health insurance policy totaled 7470 a year for single coverage. On average employers paid 83 of the premium or 6200 a year.

Income tax rates range from 0 to 399 with. Mississippis state income tax is fairly. Employers pay 83 of health insurance for single coverage.

Many of your employees wont have post-tax deductions which can be anything from garnishments like child support to life insurance. Examples of voluntary payroll deductions include. In 2022 these deductions are capped at the annual maximum of 42371.

Typically this is your gross earnings minus employer paid health insurance and any Flexible Spending Account FSA contributions. This page is for employers and provides links to the current and previous years of T4032 Payroll Deductions Tables including the Federal Provincial and Territorial Income Tax Deductions the Employment Insurance premiums and the Canada Pension Plan contributions. Total Non-Tax Deductions.

APEX Team International SRL disclaims liability to any person in respect of. Employees who pay for health insurance with pre-tax dollars through payroll deductions arent eligible to take a further deduction for these same expenses. Federal Income Tax Withheld.

The 4000 is. It is not intended to be an advice on any particular payroll calculations. Also known as payroll taxes FICA taxes are automatically deducted from your paycheckYour company sends the money along with its.

You must also contact the insurance clerk or payroll officer at your employer so that they can change your name on your Retirement Contribution Report. Name changes cannot be made online through the Member Online Services. Employer-sponsored health insurance premiums are often tax-deductible so you dont have to pay taxes on the premiums.

Calculating payroll for employees. In 2021 year-to-date earnings is not required or used for incomes under 142800 per year or if your current year-to-date earnings plus your current payroll does not exceed 142800. Voluntary payroll deductions cannot be withheld from an employees payroll check unless that employee authorizes the deduction.

After completing the Self-Employed Health Insurance Deduction Worksheet in the Instructions for Forms 1040 and 1040-SR she can only deduct 4000 on Form 1040 or 1040-SR. Retirement or 401k plan contributions. This is where it gets a bit tricky You cannot take the deduction for any month you were eligible to participate in any employer including your spouses subsidized health plan at any time during that month even if you did.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period. All you need to do is to be eligible for coverage through a group plan to lose the ability to claim the self-employed health insurance deduction. Find the sum of payroll taxes.

The monthly premiums for health insurance plans vary depending on the plan you choose how much your employer pays and your deductible amount. Have a copy of the most recent pay stub to enter all pay and deduction information calculate and compare net pay to the pay stub could be off by pennies due to rounding.

Are Payroll Deductions For Health Insurance Pre Tax Details More

Payroll Online Deductions Calculator Flash Sales 56 Off Www Wtashows Com

Payroll Online Deductions Calculator Discount 54 Off Www Wtashows Com

Payroll Tax Calculator For Employers Gusto

Paycheck Calculator Take Home Pay Calculator

Payroll Formula Step By Step Calculation With Examples

Paycheck Calculator Take Home Pay Calculator

Payroll Online Deductions Calculator Flash Sales 56 Off Www Wtashows Com

What Are Payroll Deductions Article

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Download Itemized Deductions Calculator Excel Template Exceldatapro

Payroll Tax What It Is How To Calculate It Bench Accounting

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Pay Calculator With Taxes Deals 50 Off Www Wtashows Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Medical Deductions In Payroll

How To Calculate Federal Income Tax